If you’re reading this article, you likely received a notice from your state unemployment office about a former employee attempting to collect unemployment. Almost every month for the past 12 years, our team has worked with our clients on unemployment claims across seven states. We want to use that knowledge to help you respond to the unemployment claim.

In this article, we are going to learn:

- What is Unemployment Insurance?

- What Does an Unemployment Claim Look Like?

- Can I Appeal an Unemployment Claim?

- Who Pays the Unemployment to the Former Employee?

- How Does a Former Employee Claiming Unemployment Affect My Business and My Future Unemployment Tax?

So What is Unemployment Insurance Anyways?

Unemployment insurance is a benefit provided by the state for employees who have lost their job by no fault of their own. They must have just reason, which we will discuss shortly, for no longer working in order to collect these benefits. A worker may apply for unemployment benefits that are provided by state and federal government agencies to help them through the difficult transition. For those that are eligible, unemployment benefits can be received for up to 26 weeks while they look for other employment.

The money for unemployment benefits is funded largely through employer payroll taxes collected by the state during the year. For more information on the breakdown of what unemployment insurance is, check out this article from Investopedia.

Prefer to watch instead of read?

What Does an Unemployment Claim Look Like?

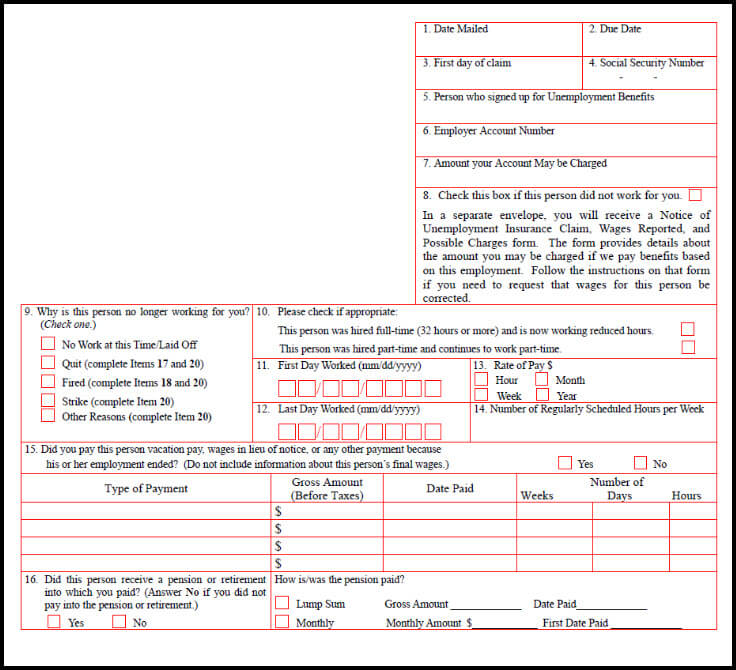

Your business will receive a letter in the mail from your state’s unemployment office when your former employee files a claim for unemployment. This will be mailed to the business address your state’s unemployment office has on file.

States vary on how many days you have to respond to the letter. It is usually anywhere from fourteen to twenty calendar days, therefore that makes it a short time period in which business owners have to respond. The letter will specify the length of time to respond, ask you to answer employment questions and may request documentation. If you fail to respond in a timely manner, the former employee could win the claim regardless of termination reason.

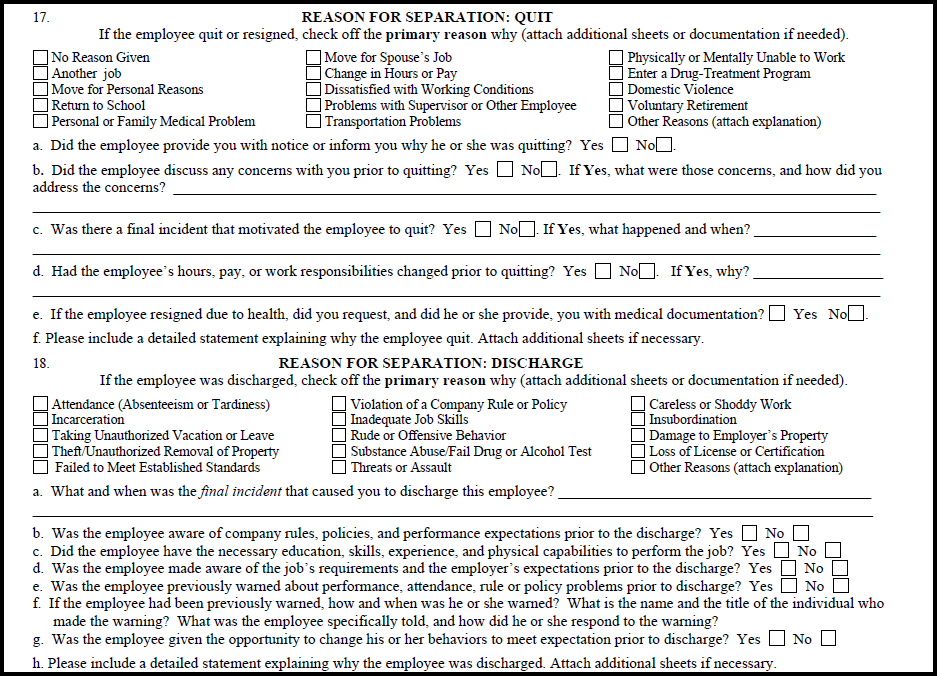

Depending on your state, the form will look slightly different but they will want to know the same information.

You should respond by emailing, faxing, or mailing the completed form with requested documentation within the time frame allowed. Your letter will state which options are acceptable to return the form and it is available, in some states, to be filled out online. The state will then take your response in consideration while making the determination as to if this former employee is able to collect unemployment insurance.

Please let your accountant or payroll processor know about the letter immediately and they will either take care of it completely or work with you on the steps you need to take.

Can I Appeal an Unemployment Claim?

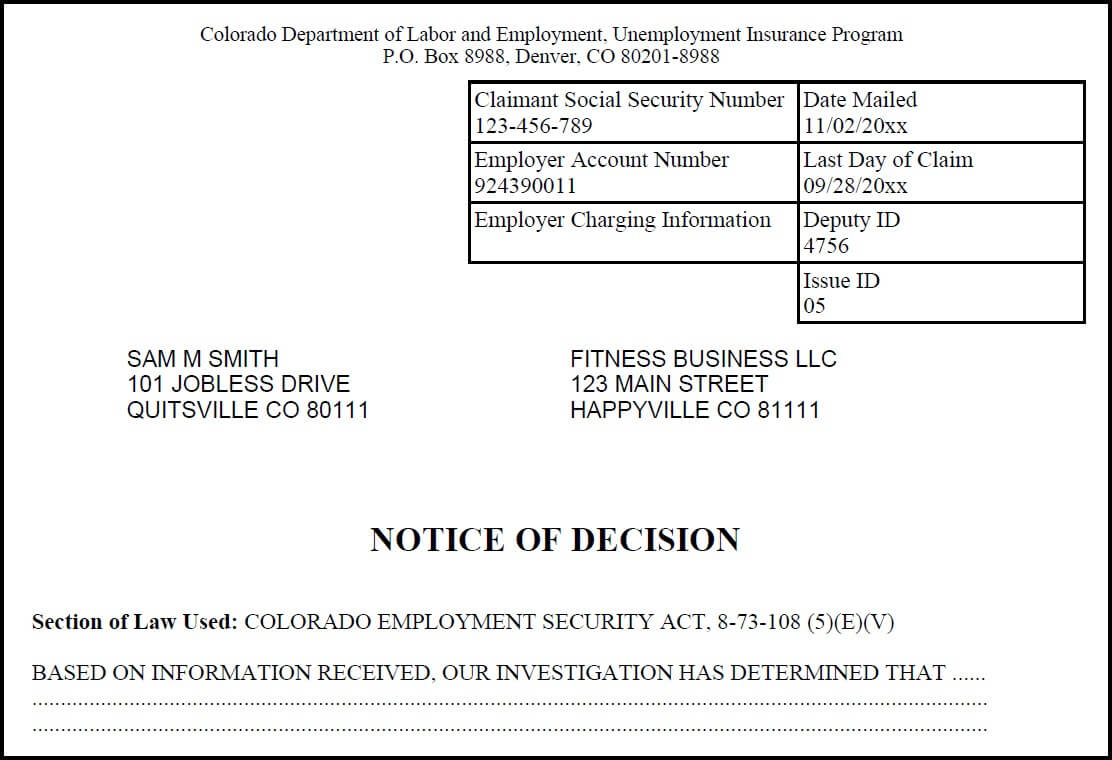

Just a couple weeks after filling out all the necessary paperwork from the state and submitting it in a timely fashion you will receive a notice of determination. The notice of determination states whether that the former employee may be, or may not be entitled to receiving unemployment benefits.

If you believe that your company is not liable for a decision in the employee’s favor, then you can send in a written appeal to your state’s unemployment division, often called The State Department of Labor. You can find the address to mail the appeal on your state’s unemployment website or on the determination notice you receive in the mail. Different states vary on the number of days you have to appeal once you receive the determination notice.

Possible Reasons for appealing an unemployment claim:

- The person filing was an independent contractor, not an employee.

- The former employee was fired for misconduct, willful behavior or other justifiable cause (you will want to have some documentation to support this).

- If the employee quit without good cause, rather than being terminated. An employee is not eligible to collect if they are simply dissatisfied with their job or decided to leave your employment of their own free will.

Possible Reasons for a Legitimate Unemployment Claim

- Being laid off from a job because there was a lack of work or there was downsizing

- Being let go because the business was having financial troubles

- If the former employee resigned for good cause such as harm or injury would have come to the employee if they had stayed

- Demotions, changes in job duties, pay cuts, and medical reasons may also be valid reasons depending upon the circumstances and state.

As fitness accountants, we often see claims from fitness instructors attempting to collect unemployment who were legitimate independent contractors. While independent contractors are not eligible for unemployment, they often mistakenly believe they can collect unemployment.

In these instances, we recommend you work very closely with an accountant (or better, The Fitness CPA) who has experience responding to these claims. When hiring instructors as independent contractors rather than employees it is important to respond in a very particular manner in order to prevent the State Department of Labor from questioning your workers’ classifications as employees or independent contractors. An audit from the State can be both very timely and very costly.

Who Pays Unemployment to the Former Employee?

Each state has an unemployment reserve fund. The unemployment taxes you and other employers pay each quarter go into this reserve fund. Then when a former employee of your business files for and is successful in making an unemployment claim, the money is paid to them directly from the state’s reserve account, not your company’s bank account.

How Does A Former Employee Collecting Unemployment Affect My Business and My Future Unemployment Tax?

Your business pays into the unemployment tax system every quarter based on that quarter’s wages and assigned tax rate. Over time your company “fills up its unemployment bucket” with your quarterly tax payments. As the bucket fills higher and higher, the state lowers the unemployment rate you pay on current employees, thus resulting in a lower tax liability for your business.

A former employee unemployment compensation is paid directly by the state to the unemployed person and the claim will reduce your ‘bucket’ or amount of credit you have with the state. So if it only empties your bucket a little bit, then it may have a small effect on your future unemployment rate or possibly no effect at all.

If your bucket is constantly drained from claims then The Department of Labor can increase your tax rate in the following year. The increased tax rate means that your business will pay a little bit more into the system to offset the former employee’s claims against your account.

It is critical that any unemployment notices from the state are replied to immediately as this will keep your unemployment taxes as low as possible. Responding within the allotted time prevents former employees from unjustly collecting unemployment benefits if they quit or are otherwise ineligible for unemployment.

We often see workers new to the fitness industry who choose to leave their jobs and then attempt to file an unemployment claim. These claims are the easiest to respond to and win, you simply need to complete the form and declare that the employee quit.

In conclusion, your business does not pay a former employee’s unemployment directly. A valid claim against your company may temporarily increase your unemployment tax rate and your business will pay more unemployment tax on a quarterly basis for a period of time. When your business has no claims for a period of time, the rate will go back down. If you believe your company is not liable for that prior employee’s claim, you can and should file an appeal in order to minimize the taxes your business pays.

For any questions or help with a specific unemployment claim, please reach out to us and we’ll be glad to help.

- What is a Colorado Periodic Report? - February 27, 2019

- What to Do When A Former Employee Files an Unemployment Claim? - December 10, 2018

- How To Register for a New Colorado Sales Tax License (a Step-by-Step Walk Through for Fitness Businesses) - November 19, 2018

Pingback: "What to Do If Former Employee Files for Unemployment" - Unemployment Tracker

Pingback: What to Do with Your Fitness Employees: Unemployment and the Paycheck Protection Plan - The Fitness CPA

Pingback: What to Do with Your Fitness Employees: Unemployment and the Paycheck Protection Program - The Fitness CPA

Pingback: Workers Refusing Work: What to Do? | The Fitness CPA