Final guidance on the Paycheck Protection Program is here at this link. It was released Thursday, April 2 around 7pm ET.

We have no resources or educators guiding us on this short timeline. Please note it is also called “Interim Final Rule” which is a bit of an oxymoron. Is it final, or it is interim? Needless to say, this a rush job and a clusterfuck of ultimate proportions. But, are you really that surprised?

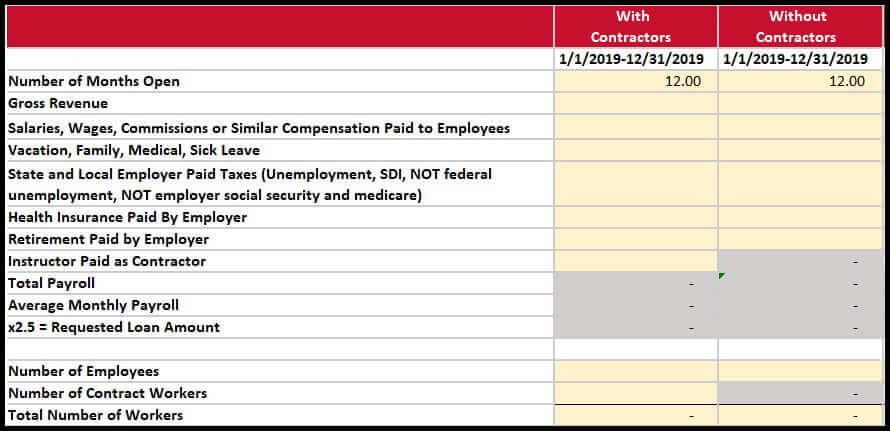

We’ve created our own excel available to you here. You’ll note there are a lot of options, more on that below.

And remember, all of the PPP loan forgiveness presumes you will hire back the same amount of staff by June 30th. Now that could change, but that’s currently the law. So something to keep in mind as you think about all this money being ‘free’ but then also potentially being a loan if you don’t reopen and bring back employees onto your staff.

A *HUGE* technical correction was issued. Despite the original legislation saying otherwise:

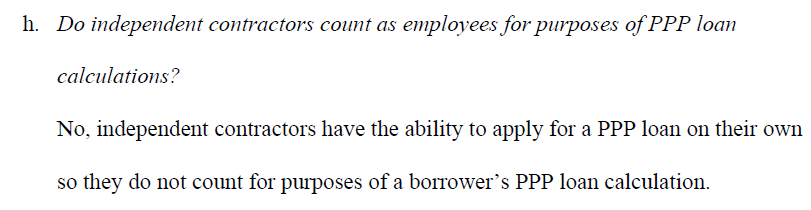

- · We regret to announce that independent contractors are NOT part of the calculation in the interim rules posted above. It is very clear contractors are meant to be excluded as of 4/2/2020 guidance.

- · On page 11:

- · On page 11:

- · If you elect to incorrectly include independent contractors you may get the money but it will not be forgivable and will be a 4% loan as the interim regulations currently stand. Note this is just how the current level of guidance is directing us. It could change, though these rules seem much more black and white than prior guidance.

- · This means that many of you who pay your instructors as independent contractors will end up with calculations where the PPP Loan amount will be <$10,000. In these instances, you will be better off with the $10,000 of grant money included with the new EIDL application.

- · This is obviously a huge blow for businesses who rely on contract workers and a huge misunderstanding of the gig economy by our government as business owners will be forced to either:

- · Lay off independent contract workers due to lack of funding (who are then eligible to file for their own PPP next week)

- · Borrow from EIDL funds and repay those funds as a loan.

- · Our guidance remains the same, unless you have deep pockets, do not continue paying workers of any kind unless they are doing actual work and essential to your business. In other words, the government is their bailout, not you.

The ERTC Credit is also an option, but there is not enough time to run scenarios. Go for PPP or EIDL and decline if we later figure out that ERTC is better.

The guidance says to use the prior 12 months:

- · Which would technically be, 4/1/2019-3/31/2020.

- · But COVID19 hit in March, so we believe 3/1/2019-2/29/2020 is the best representative month since most of us were closed for half of March.

- · And of course, they could also mean 1/1/2019-12/31/2019.

- · Be aware payroll reports for Q1 2020, if required, will not be available for 2-4 weeks (mid to late April).

- · We might recommend picking the result that provides the highest loan and pay back any excess that isn’t forgiven in the final calculations as a 4% loan. Further guidance will direct us which 12 month period is acceptable.

Confused yet? We are. Maybe there’s some bailout money at the end of the Port-O-Pot rainbow.

Good luck!

Q: Wait… wait… can you help me?

A: If you’re our client, check your inbox in the morning as we will have completed the sheet for you. I’ll be up early for extra questions, so just email me and I will respond. Or call me 720.608.4608. If you’re not our client, email me [email protected] and I’ll work to respond as soon as possible.

We also did three Q&As here you might find useful:

-

· Explain the Paycheck Protection Program to me.

-

· Paycheck Protection Program Q&A #1

-

· Government Bailouts, PPP & EIDL Q&A #2

Q: Will the application still open up Friday morning? Do I still need to wake at 6am ET?

A: Maybe… it’s bank dependent. I will be up early and checking every 15 minutes. It’s possible your bank may not have the application available until this weekend or next week. I’ve heard rumors that several banks will not be ready Friday, April 3rd. Get a bank contact, ask them to alert you when it’s available. And also continuously check their website no matter what.

Q: If I wait to do the application for one reason or another, will the money be gone?

A: Possibly. Better safe than sorry.

Download our excel template here:

You can sign up for future updates here or visit our COVID-19 Resource Hub here.

- Which Of Your Tennis Club Programs Are Actually Profitable? - September 30, 2025

- Why Your Fitness Studio Needs a Google 360 Tour - August 15, 2025

- Fitness Bookkeeping Made Simple: A Beginner’s Guide - July 14, 2025