Congratulations – you’re starting a new gym, Crossfit box, HIIT, cycling, yoga, Barre or Pilates studio and you need a sales tax license. We’ve registered nearly 100 businesses in Colorado and other states across the nation and we understand how confusing the process can be, especially if this is your first time. By the end of this article you know exactly what to do in order to register for a sales tax license in the state of Colorado with our step by step walk-through for fitness business owners like you.

To register your sales tax license you have three options: do it yourself, hire an accountant like us here at The Fitness CPA, or use one of the bigger corporations online like Avalara, TaxJar, or Legal Zoom. At the time of writing this article, all of the online corporate websites require calling in to speak with them about the registration process and no one has a step by step guide. This article will focus on empowering you to complete the process yourself in an effort to minimize your startup costs. Fees from professionals can range from $100-$200 to complete this single registration. As accountants, we know how important it is to save every dollar when starting a new business. So let’s get started with an overview of the topics we’ll cover today:

- -Why Do I Need A Colorado Sales Tax License?

- -What Do I Need To Register For A Colorado Sales Tax License?

- -Where Do I Register for a Sales Tax License?

- -Step by Step Guide for How to Register for Colorado Sales Tax License

- -How Much Does It Cost to Obtain a Sales Tax License?

- -How and When Will I Receive My Sales Tax License?

Why Do I Need A Colorado Sales Tax License?

When starting a new Colorado business, it is important that you register your company with your state (and sometimes city) for a sales tax license to stay in compliance with the requirements and to prevent penalties and fines. Except of course in these five states where there are no sales taxes – Alaska, Deleware, Montana, New Hampshire, and Oregon. Also you may have already discovered that when you try to buy inventory to sell at your new business, your vendors will ask for your sales tax license number. Your business does not pay a sales tax when you purchase items for resale, instead, sales tax is collected when the end consumer makes the purchase from your fitness business.

The State of Colorado requires that your business collects sales tax when you sell retail items such as clothing, other apparel, yoga mats, food and beverage. As a retailer, you will need to collect and remit that tax to the government. However, state sales tax is not collected on services such as studio/gym memberships, teacher trainings and workshops thus you do not collect and remit tax on that service based portion of a customer’s purchase. Then at the end of each month, quarter or year (depending on the amount of sales tax collected) you will report your total sales to the state. Both service and retail sales are reported, however in Colorado sales tax is only collected and remitted on retail sales. Conveniently, when you register for your sales tax license, you can also register for your state withholding account number at the same time if you plan to have employees.

What Do I Need To Register For A Colorado Sales Tax License?

You will want to have these items handy before you start the online registration process.

- Name and address of your business.

- Type of business (Sole Proprietorship, Corporation, S-Crop, LLC, etc).

- If you are an LLC, ask your tax accountant how your LLC is taxed.

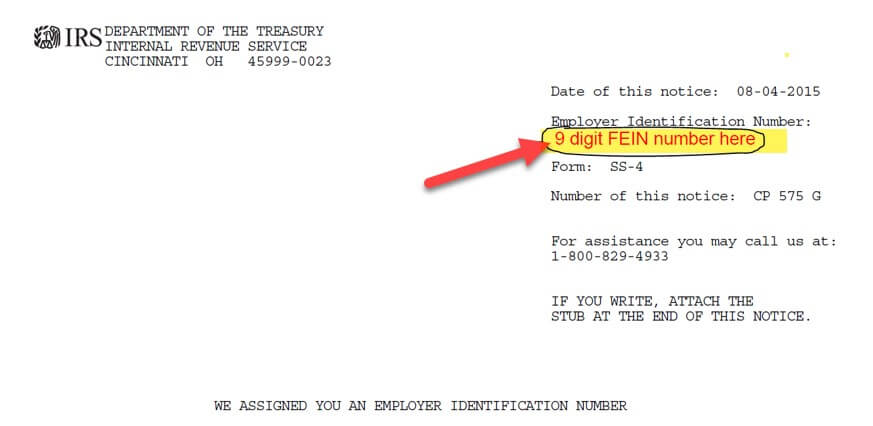

- Your FEIN (Federal Employer Identification Number).

- This can be found on your IRS form SS-4.

- All owner/partner/corporate officer information: name, address, social security number, and phone number

- Business bank account information. Your bank name, address and phone number along with your bank account and routing number which are found on the bottom of your business checks or you can login to your online bank account to find this.

- NAIC code for the type of products and services you will be offering. The NAICS is the North American Industry Classification System. Each business type is categorized under a different number. Go here The Census Webpage here to look up your business code. (Hint, hint….if you are a fitness center, your code is 713940)

Where Do I Register for a Sales Tax License?

The State of Colorado Mybiz website takes you through a series of questions that guides you through the process of registering for your license. In addition, the State website will help you determine what other state registrations you may need to complete for your business. To begin, go to the State of Colorado website here.

Step by Step Guide for How to Register for Colorado Sales Tax License

First question…. “Have you already filed your trade name or business with the Secretary of State?” If you haven’t, you can do this fairly quickly at The Secretary of State’s business search located here or ask your tax professional to assist you with this filing.

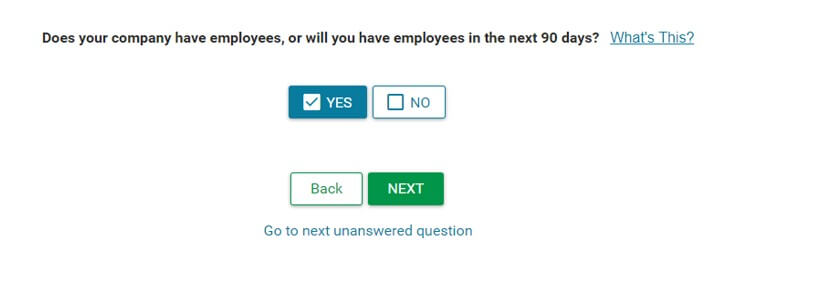

Next question. “Does your company have employees, or will you have employees in the next 90 days?” If so, check yes and they will guide you through the process to issue you a withholding account number so you are prepared to pay employees and collect/remit the appropriate payroll taxes.

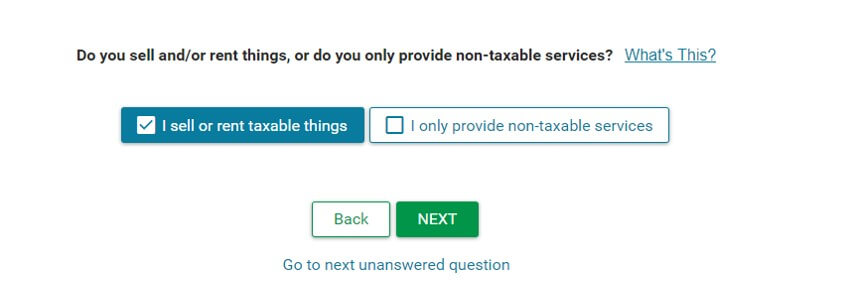

This third question is the important one to let the State know you will be selling retail items and collecting sales tax. “Do you sell and/or rent things, or do you only provide non-taxable services?” Check yes here if you sell retail items. Do not check this item if your business is a service only business.

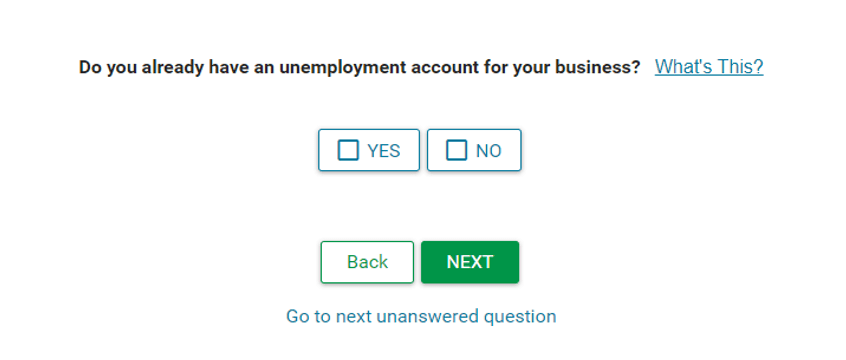

Next on the list is “Do you already have an unemployment account for your business?” If you do….great, click “YES”. If not, there will be guidance at the end of this first set of questions on where you need to go to apply for your unemployment account.

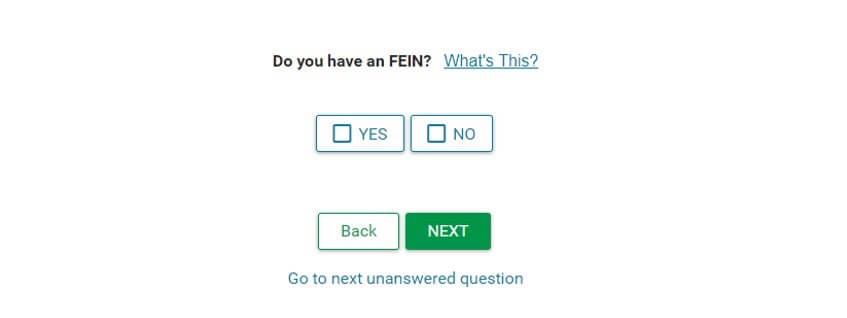

“Do you have an FEIN?” This is the Federal Employer Identification Number. This is a nine digit number found on your SS-4. Ask your tax professional if you are not sure.

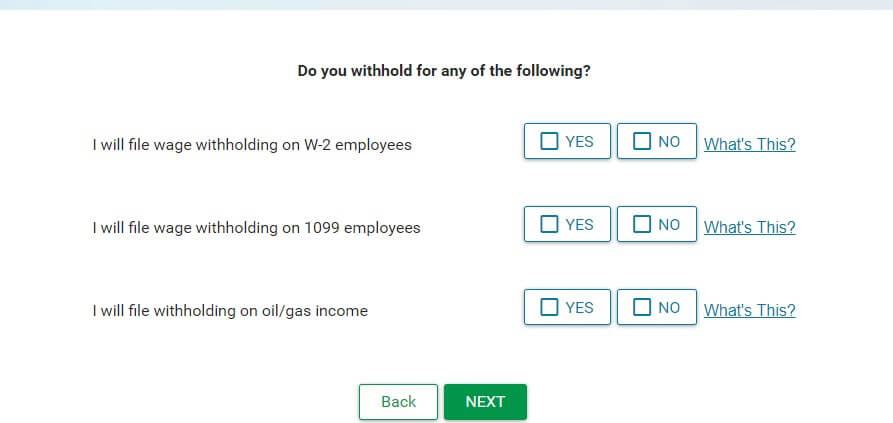

Now the application asks for additional information about wages and income. For fitness centers, more than likely you will check “YES” to wage withholding for W-2 employees and “NO” to wage withholding for 1099 employees aka contractors. Even if you use contractors (and you probably will being in the fitness industry), you do not want the additional burden of collecting and remitting this tax for the contractors. More than likely you will hit no for the oil/gas income unless your fitness studio has a service station attached to it… which could be cool.

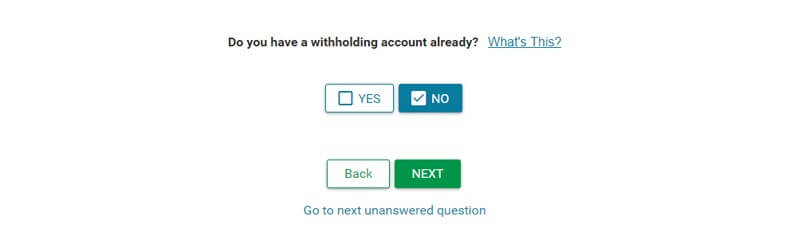

Next is “Do you have a withholding account already?” More than likely your answer is “NO” if you are a brand new business.

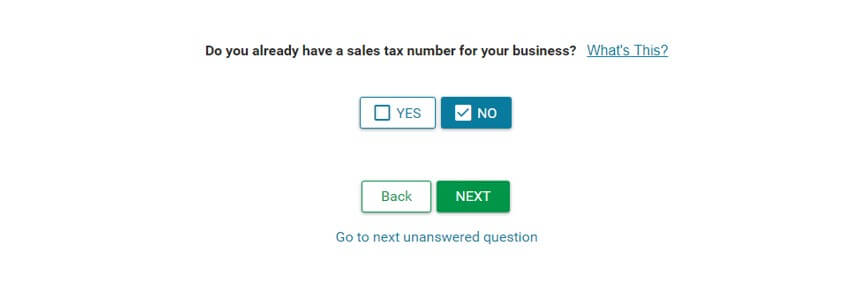

Then “Do you already have a sales tax number for your business?”…nope… that’s why we are on this journey.

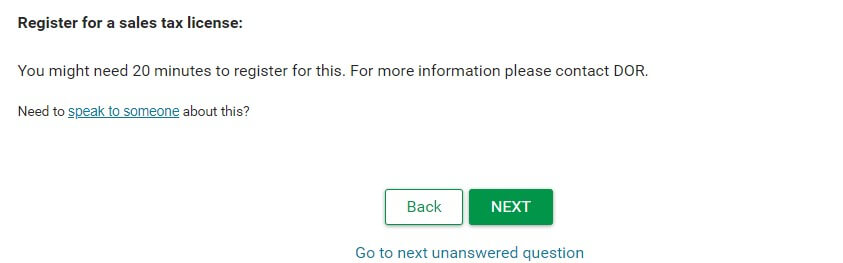

At the end of this initial screening process, the registration process will give you a list of items you need in order to register your new business. Estimated times are included for approximately how long the full registration process will take to compete. This is when the actual sales tax application process actually begins.

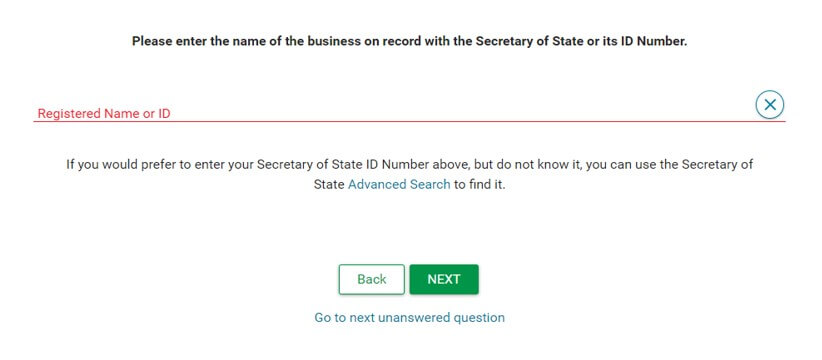

Moving on to the sales tax portion of this process it will ask for your registered name or ID with the Secretary of State. Be sure to match it exactly as it’s typed on your Secretary of State Registration. You can search for your business registration here on the Secretary of State’s Website.

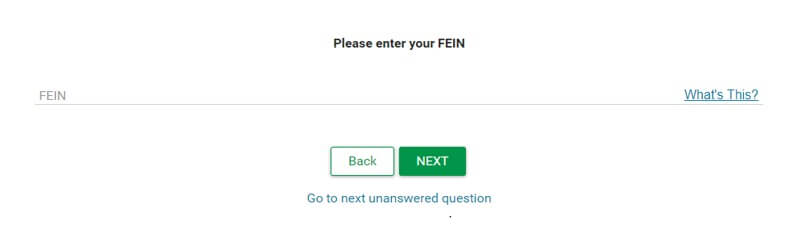

Next, enter your Federal Employer Identification Number

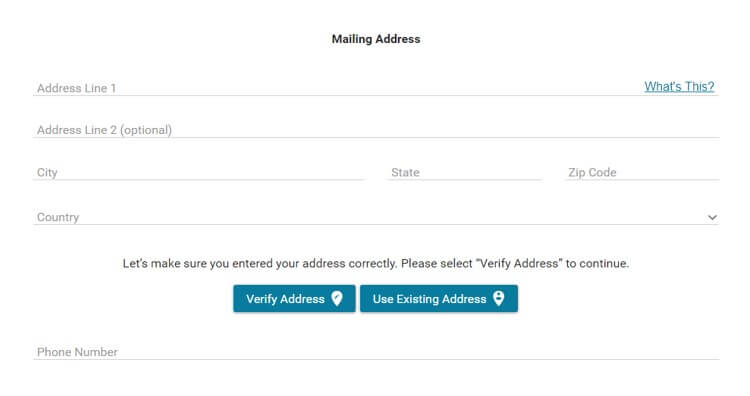

Enter your mailing address in this section below. This is where your sales tax permit will be mailed. Many taxpayers prefer to use their home mailing address for tax mail rather than the business address, especially if your physical business location is not open yet.

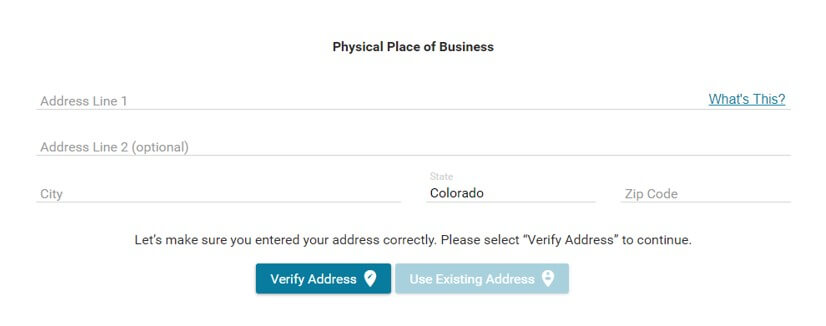

Then enter the physical address of the business. If your business location is not decided yet then you are permitted to use your home address.

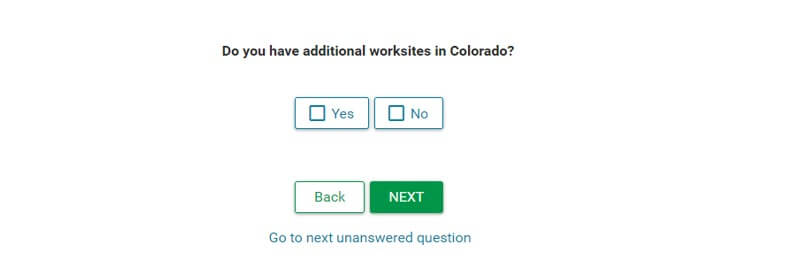

“Do you have additional worksites” If not, click “NO” and move on. If you do, click “YES” and it will walk you through the steps to add the worksites. In most instances and if this is your first and only location the answer will be no.

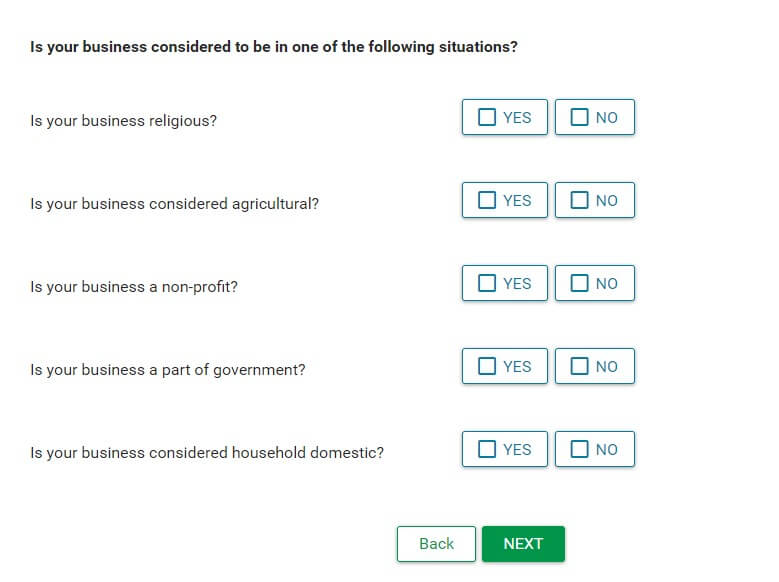

Some additional questions to help narrow down which taxes you would need to collect and remit. For most fitness studios, all the questions below will be “NO.”

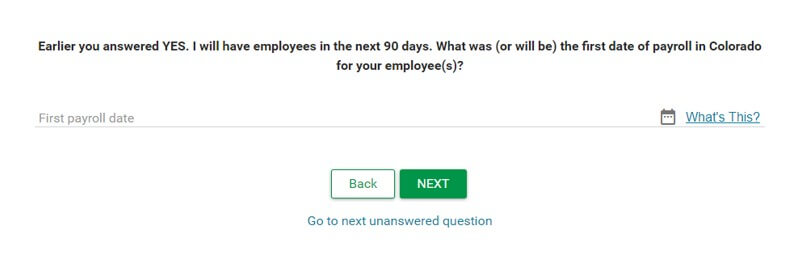

If you answered “YES” to the earlier question that you will have employees within the next 90 days, it will now ask “What was (or will be) the first date of payroll in Colorado for your employee(s)?”

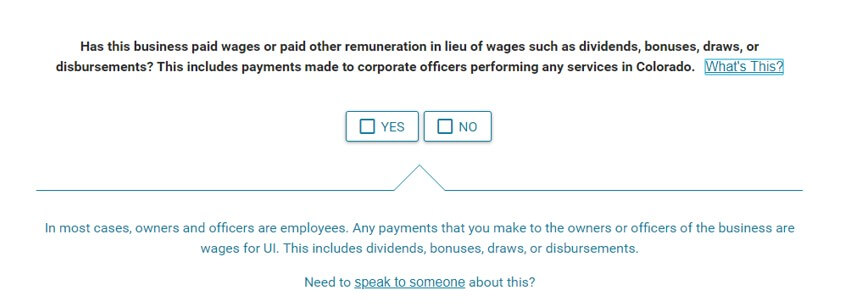

Have you paid any other types of payments outside of the regular payroll or any payments to officers? Please check “NO” on this. If you believe you need to check “YES” on this please talk to your accountant before proceeding as this will complicate the registration process.

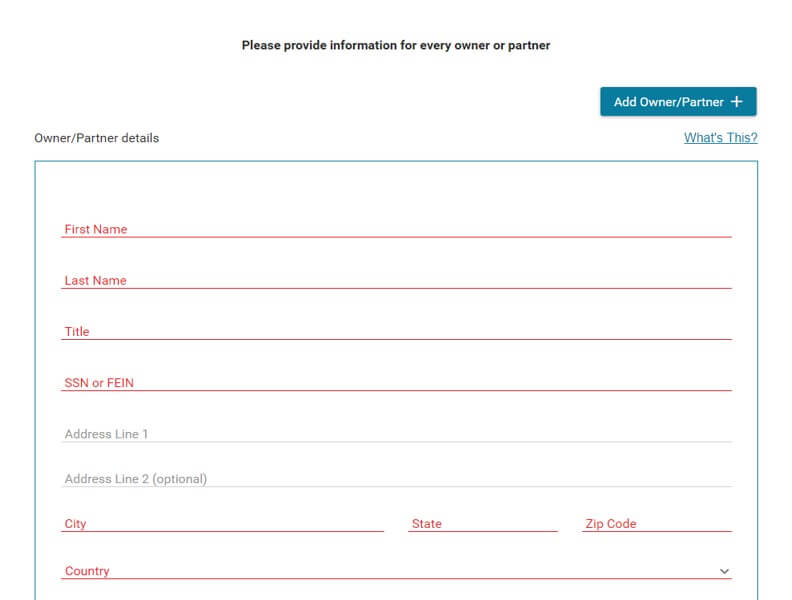

It will then want the details of the owners, or partners, of this business. You can add multiple owners or partners.

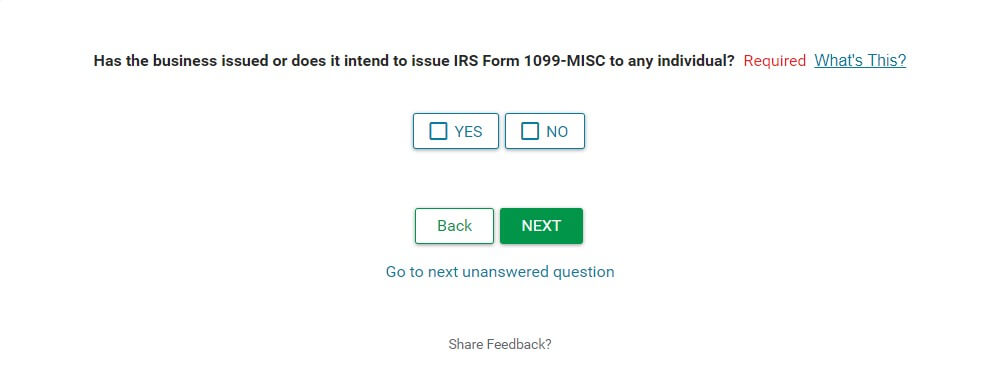

The following question is for if you are planning to have contractors. If you are a fitness studio, you will more than likely hire contractors as instructors and have to issue 1099s at year end so your answer would be “YES”.

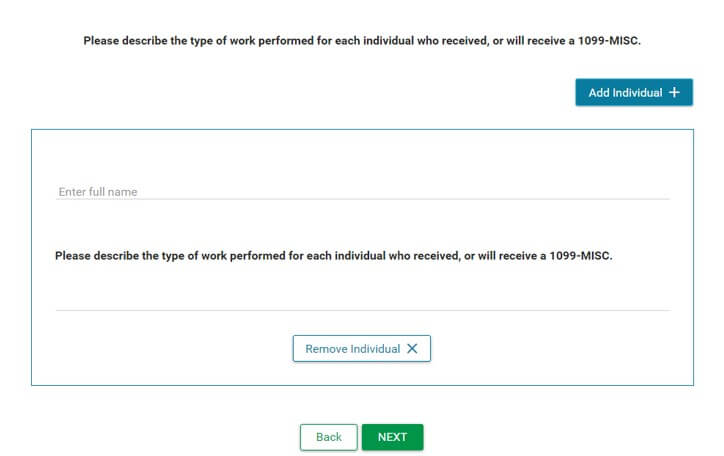

Your answer to the next question will depend on your business. “Please describe the type of work performed for each individual who received, or will receive a 1099-MISC.” As stated earlier, if you are a fitness studio then more than likely you would put fitness instructor as the description for the types of contractors you will be hiring.

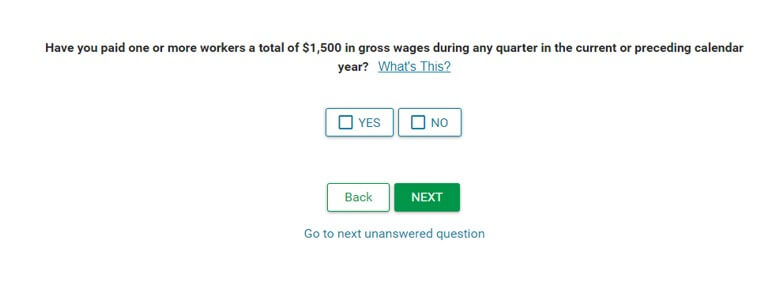

Next, if you have paid employees already, they will want to know this for withholding tax purposes. “Have you paid one or more workers a total of $1,500 in gross wages during any quarter in the current or preceding calendar year?”

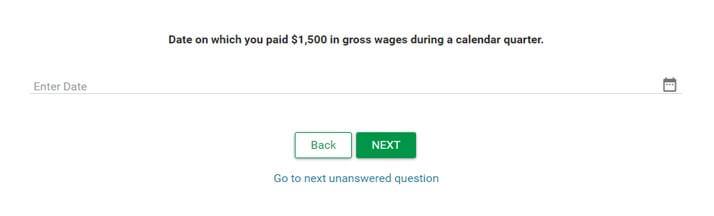

“Date on which you paid $1,500.00 in gross wages during a calendar quarter” is what they want to know next.

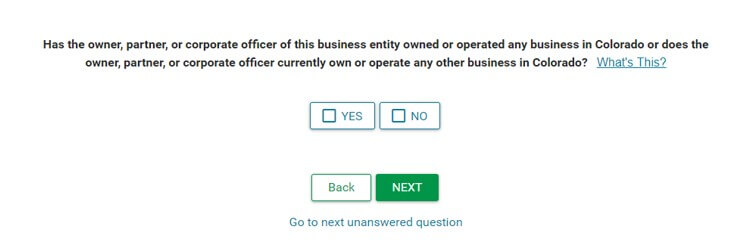

Do any of the owners or partners of your business currently own/operate another business in Colorado or have they previously?

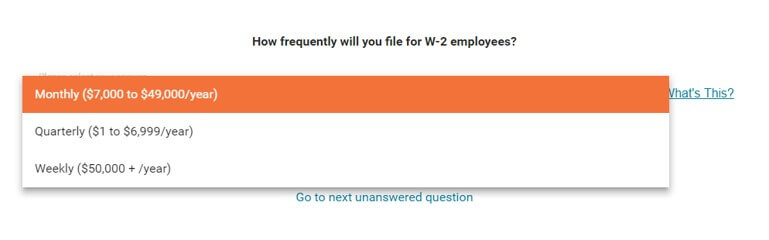

How often will you file for a W2 employee? This is based on the amount of Colorado wage withholding collected within a year. Regardless of the amount of withholding you think you will have we recommend most businesses select the “Quarterly” option. In our opinion, there is no circumstance where weekly should be checked for a new business.

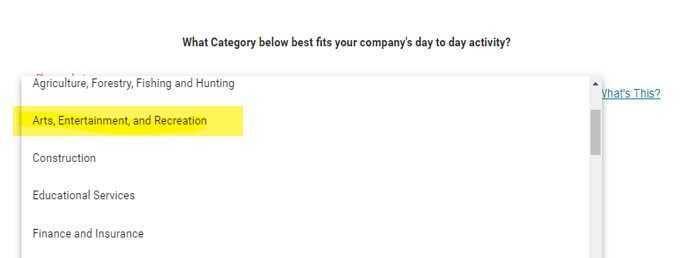

They now want to know a broad category of what your business fits into. Select “Arts, Entertainment, and Recreation”.

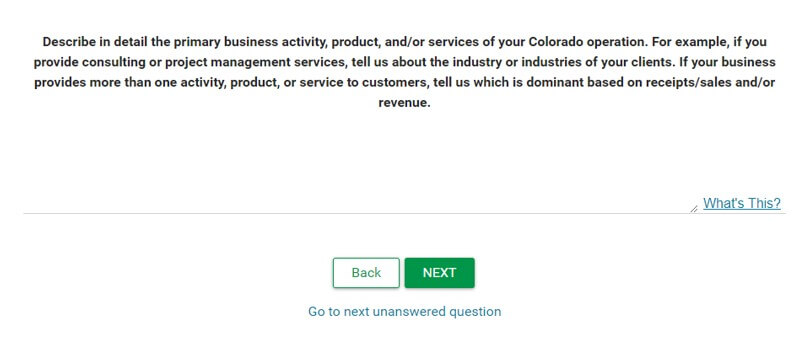

Now a more detailed description in your own words as to what your business is. An example could be “a fitness studio that offers classes, training and has a small area for retail sales of fitness clothing and accessories.” If you feel this describes what you do, please feel free to copy and paste this description into your registration question.

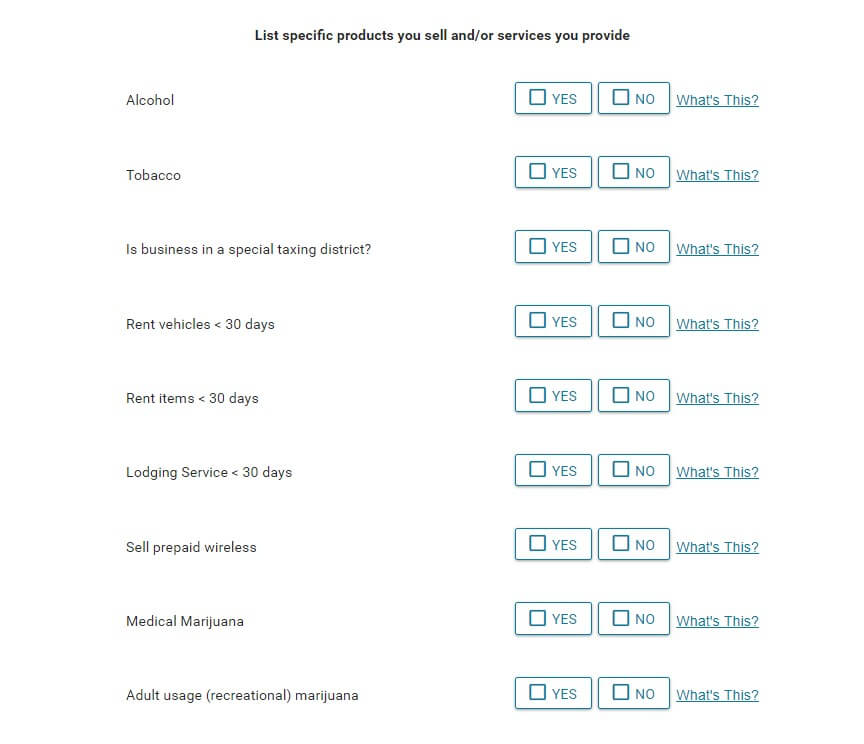

The next question asks you to “List specific products you sell and/or services you provide.” Will you be providing any of these services/products? As a fitness studio, your answer is most likely “NO” for the following questions.

To see if you are in a special taxing district, you can look it up on the Colorado form DR1002 found here or ask your tax professional.

Now list the specific products and services you offer like memberships, classes, teacher training, and possibly retail items like clothing, supplements, etc.

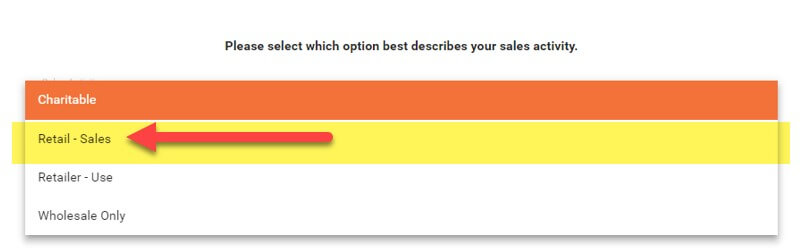

For fitness studios, your sales activity will be “Retail – Sales” only if you sell any retail goods. If you don’t sell retail goods you’ll select “Retailer – Use.”

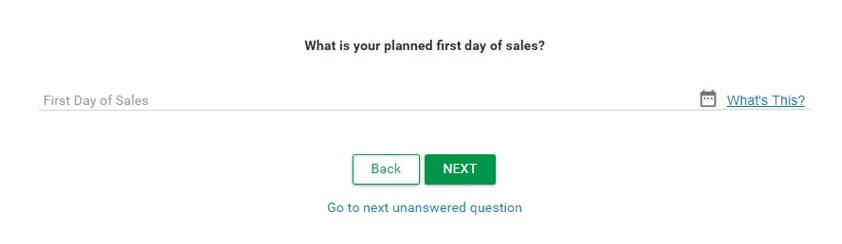

Put the best estimate of your upcoming first sales. If you will be selling items before your physical business location opens, this will count as well. Examples would be at an open house event or an event where you will sell products, such as a festival booth.

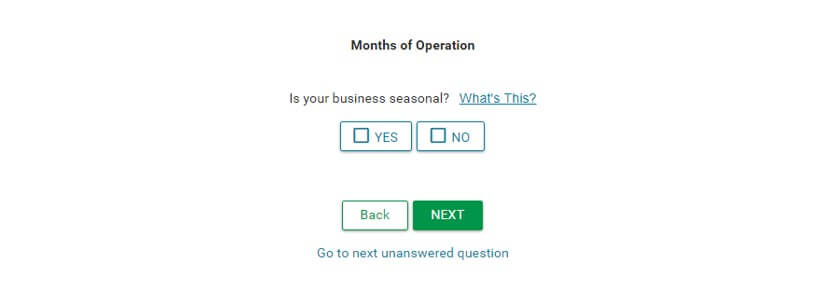

Is your business seasonal? For fitness studios and gyms this answer will be “NO” as you will want to be open and available all year.

*Depending on your individual business and business needs, your answers and questions may be slightly different than the screenshots above but overall you will need the same basic information.*

Next, you will be asked to enter your bank account informatioon. Once you have entered all of this information your bank account will be verified and charged a fee of $50. On the next screen, your sales tax number is ready to be downloaded and you can start making purchases as a retailer.

Alternatively, you can fill out a PDF version of the CR 0100 here. If you fill out the PDF version, follow the instructions to mail in the application or walk it into your local Colorado Department of Revenue office. We recommend the online process in order to receive your license number immediately. This will enable you to start putting the pieces of your business together sooner rather than later.

How Much Does It Cost to Obtain a Sales Tax License?

For a two year license it will cost $16 plus a $50 deposit. The $50 deposit is refunded once your business remits $50 in sales tax to the state.

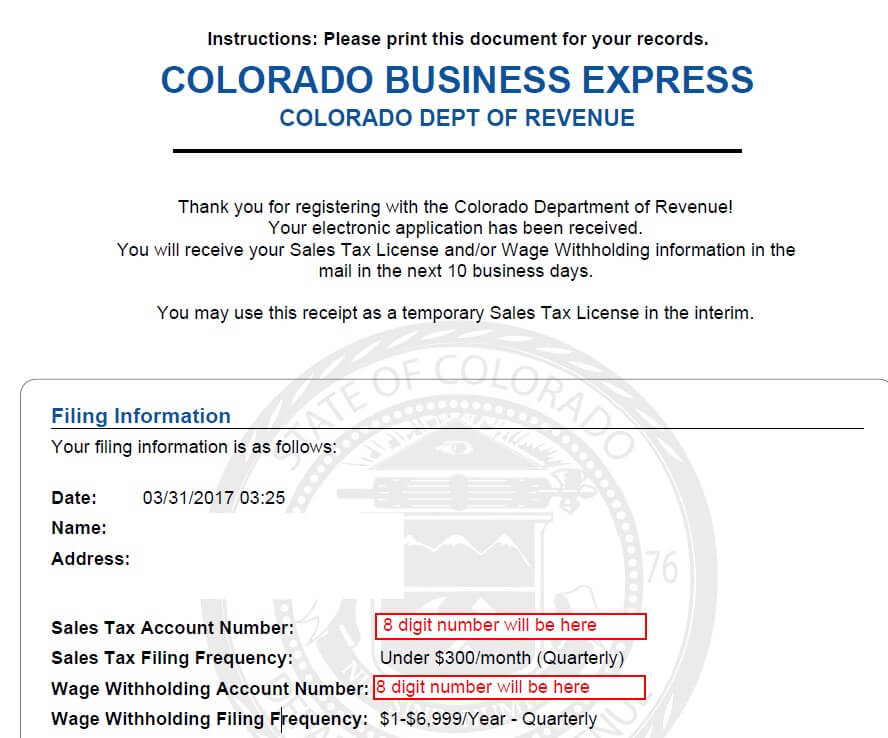

How and When Will I Receive My Sales Tax License?

When you fill out the online CR 0100, through the above process on MyBiz, you are assigned a Sales Tax License number (and a wage withholding account number if you completed that section as well) right away. It is an eight digit number. Your actual sales tax license is mailed to the mailing address entered within ten business days of submitting the registration. This license must to posted at the business address in a clearly visible place. Also you will want to scan in a copy and save as a PDF just in case. Your sales tax license is renewed every two years.

From here you will want to register to create an online account and the State has a nifty but slightly drab video which goes through the process here.

Recap of The Sales Tax Registration Process:

Go to the state of Colorado’s MyBiz website to start applying for you sales permit and have all the important documents ready in advance, follow the instructions above and save a copy of the completed license application. Phew, so that’s it? If only it were that easy. The government always makes it challenging but hopefully the steps above helped you go through the process on your own. If you run into road blocks along the way, feel free to shoot us your question and we will do our very best to help you get to the goal! You can comment below for help or reach us on our Facebook page for more help with this process.

- What is a Colorado Periodic Report? - February 27, 2019

- What to Do When A Former Employee Files an Unemployment Claim? - December 10, 2018

- How To Register for a New Colorado Sales Tax License (a Step-by-Step Walk Through for Fitness Businesses) - November 19, 2018

Pingback: Are Gyms Required to Buy Labor Law Posters? - The Fitness CPA